The world’s energy system is in crisis. Developing the capacity to deliver net zero over the next decade is set to become arguably the most important transition that humanity has ever made. Against this challenging backdrop, the decarbonisation of digital assets has become one of the most pressing challenges facing the nascent sector.

Cryptocurrencies, in particular, have built up a bad reputation when it comes to environmental impact. It’s understandable why – Bitcoin, for example, consumes more electricity in a year than Sweden, Norway or the United Arab Emirates (UAE).

It’s of course important to address the high energy consumption that some crypto assets create. But it should also be noted that some cryptocurrencies are powered by energy-efficient blockchain systems based on proof-of-stake principles – though all use electricity nonetheless.

There are ways to reduce crypto’s carbon footprint, and this is fast becoming an ESG priority for investors and regulators alike. And this is only part of a more complex story. Blockchain technology actually has huge potential to help revolutionise the energy sector by encouraging the use of renewable energy sources.

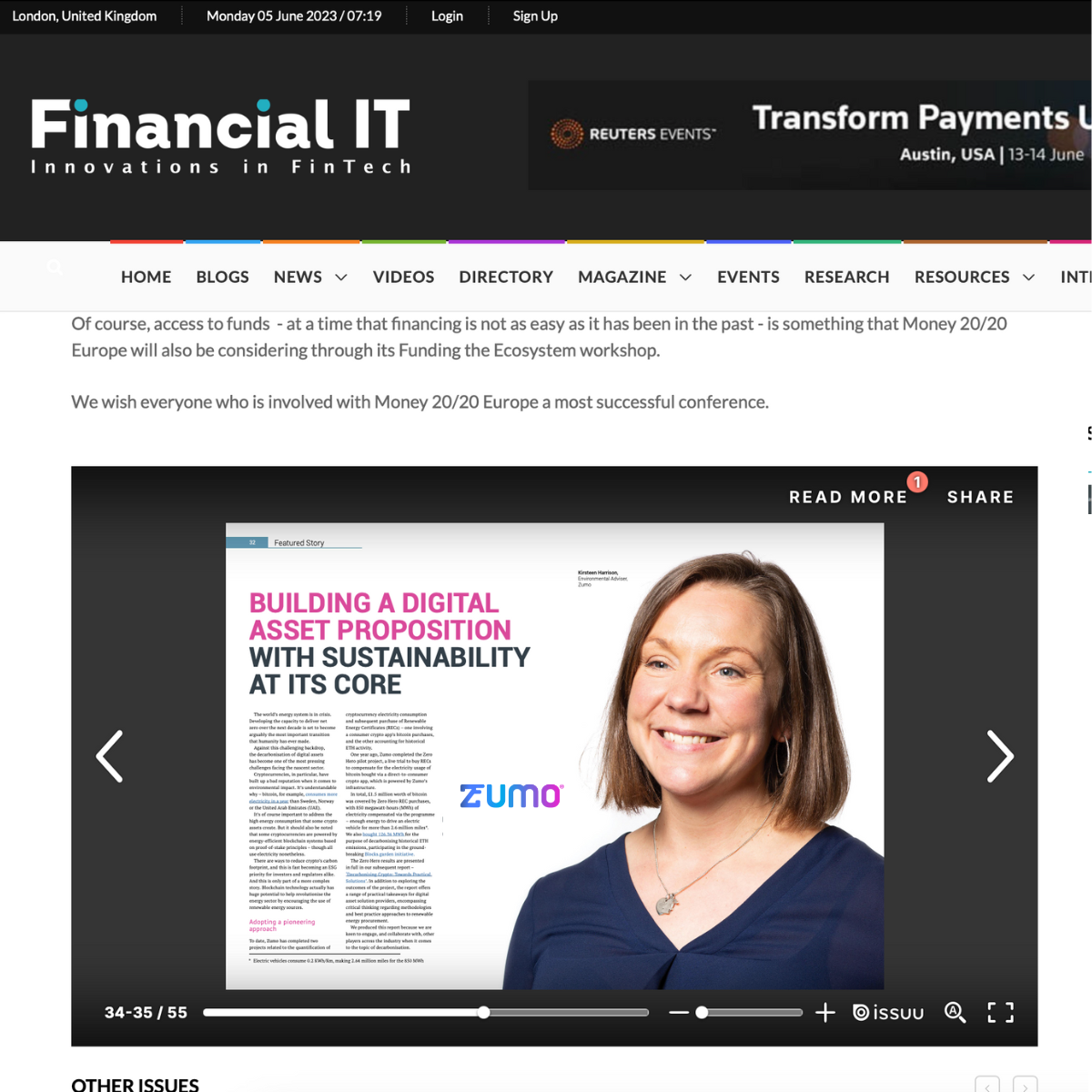

Adopting a pioneering approach

To date, Zumo has completed two projects related to the quantification of cryptocurrency electricity consumption and subsequent purchase of Renewable Energy Certificates (RECs) – one involving a consumer crypto app’s Bitcoin purchases, and the other accounting for historical ETH activity.

One year ago, Zumo completed the Zero Hero pilot project, a live trial to buy RECs to compensate for the electricity usage of Bitcoin bought via a direct-to-consumer crypto app, which is powered by Zumo’s infrastructure.

In total, £1.5 million worth of bitcoin was covered by Zero Hero REC purchases, with 850 megawatt-hours (MWh) of electricity compensated via the programme – enough energy to drive an electric vehicle for more than 2.6 million miles (Electric vehicles consume 0.2 KWh/Km, making 2.64 million miles for the 850 MWh). We also bought 126.36 MWh for the purpose of decarbonising historical ETH emissions, participating in the ground-breaking Blocks.garden initiative.

The Zero Hero results are presented in full in our subsequent report – ‘Decarbonising Crypto: Towards Practical Solutions’. In addition to exploring the outcomes of the project, the report offers a range of practical takeaways for digital asset solution providers, encompassing critical thinking regarding methodologies and best practice approaches to renewable energy procurement.

We produced this report because we are keen to engage, and collaborate with, other players across the industry when it comes to the topic of decarbonisation.

By working together on concrete actions to decarbonise the crypto sector, we believe we can turn the current narrative around digital assets on its head, making our youthful sector a standout example of the successful decarbonisation of an entire industry.

Under the regulatory spotlight

There is no time to waste. Earlier this year, the UK’s economic and finance ministry, HM Treasury (HMT), published its consultation and call for evidence on the future financial services regulatory regime for crypto assets.

As part of the process, HMT requested information from stakeholders on sustainability-related aspects of crypto asset activities. In particular, it was seeking industry views on whether the existing sustainability disclosure requirements could be modified to cover crypto asset activities. So it’s safe to say that sustainability disclosures are coming in the UK.

In the European Union (EU), the situation is further advanced. In April 2023, the EU Parliament approved its Regulation on Markets in Crypto-assets (MiCA), specifically noting its commitment to environmental impact disclosures and the need to factor this into investor decision-making.

When it comes to making the right investment decisions, we believe investors should have access to pertinent information regarding environmental impact and energy consumption. This should include a clear breakdown of the material environmental considerations, their assessed impact and the methodology applied in doing so.

In the case of digital assets, this is almost wholly a question of electricity consumption, and this should therefore form the primary focus of such disclosures. And because of this, we consider it important that electricity consumption figures are accompanied with an estimation of renewables share and progression in renewables share (as far as it is publicly available). Somewhat like an electric vehicle, the immediate environmental impact of a digital asset is as big or as small as the cleanliness of the electricity generation that powers it, and this should form a key metric for investor assessments of environmental impact.

In all cases, figures may differ significantly depending on the methodology applied. It’s crucial, therefore, that data sources and calculation methodologies are clearly disclosed, together with the reason for choosing the specific methodology applied.

Also, it’s important to share information about the measures, if any, the preparer of the disclosure is taking to mitigate the environmental impact of its own holdings or operations. This recognises that while an individual entity has no say over, for example, the overall Bitcoin network, it’s willing and able to calculate environmental impact for its own slice of network usage.

Emerging mechanisms include the RECs, used by Zumo, procured for an amount of electricity equivalent to that calculated for the investor’s/entity’s specific holdings/activity. And, critically, market-based REC procurement methods are derived from recognised accounting standards under the GHG Protocol, meaning they are interoperable with other recognised sustainability standards.

A growing international issue

It’s not just the UK and Europe that are pushing ahead on carbon-related disclosures. In October 2022, Zumo became a member of the World Economic Forum’s (WEF) Crypto Sustainability Coalition – so we’ve witnessed the wider international discourse first hand.

Part of the Crypto Impact and Sustainability Accelerator, the Coalition explored how blockchain tools can be better leveraged to contribute to meaningful progress towards positive climate action.

In April 2023, the WEF released an insight report, entitled ‘Guidelines for improving blockchain’s environmental, social and economic impact’. Zumo contributed to this landmark report, and was also featured as a case study.

Part of a series of three reports focusing on the intersection of blockchain and sustainability, the focus of this report is to outline guiding principles and provide a timely overview of the current state of play related to the environmental impact of blockchain technologies. The report provides an approach for a unified impact assessment that balances economic, environmental and social perspectives so that blockchain solutions are ready for upcoming regulation, rather than lagging behind it.

It’s therefore imperative that fintechs, asset managers and any other organisation that wishes to offer digital assets to their customers get prepared to measure and disclose the environmental impact – and quickly.

Providing the right solution

Last year, Zumo and our partner Zero Labs, a renewable-energy-as-a-service company building programmable decarbonisation technologies, were awarded funding by Innovate UK, the UK’s national innovation agency, to fund research into the decarbonisation of crypto, specifically finding practical ways in which wallets and platforms can scale the use of renewable energy.

Together, we have been working hard to conceptualise a targeted solution to help decarbonise crypto holdings. We believe that such a solution needs to effectively fulfil three criteria.

Firstly, in terms of measurement, it needs to robustly quantify the environmental impact of an organisation’s digital asset offering using publicly available and scrutinised electricity consumption attribution methodologies.

When it comes to mitigating the environmental impact of the holdings, it needs to procure strategically sourced RECs to compensate for the impact at platform and end customer level.

And last, but certainly not least, it needs to be able to accurately showcase the publicly verifiable proofs of an organisation’s climate action.

We have put a lot of resources into finding the right solution for the digital assets market, and will be able to share more soon. Stay tuned!

This article was first published in the Money20/20 Edition of Financial IT magazine, you can find more articles in the latest edition on their website here.